If your business banks online, your banking fees may be lower, as online banks may not have to pay for the cost and upkeep of branches, and those savings may be transferred to you. Plus, some banks offer 24/7 customer service, so you can speak to a customer service representative at any time. And because most financial institutions have an app that replicates its services from your phone, you have the ability to always bank on the go. Rather than driving to a bank branch and waiting in line, you may be able to deposit cheques online in minutes. Instead of sending a registered cheque and waiting for it to clear, you may securely transfer the money online. You may need to do a rapid money transfer to a client or vendor, or you may need to transfer money from one account to another. For increased efficiency, you may also set up automated bill payments, which helps you manage your cash flow when you have monthly payments to and from vendors. You can simply log into your account and pay your bill online right away.

This might be one of the top advantages of online banking because you don’t have to take time out of your day to go to the bank. You may also be able to: Pay bills online In addition to being able to bank at any time, from anywhere, there are other advantages to banking online.

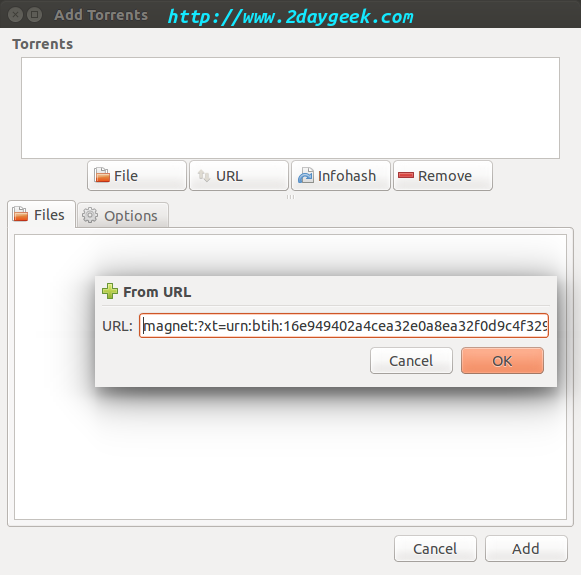

#Advantages of deluge client password

All you need is a bank account, a secure password and a good internet connection, and you can access your account from anywhere, which is especially important as we are urged to stay home. Online banking can be accessed via a computer or your bank’s mobile app. Loan applications for business loans, credit cards or lines of credit.Deposits to retirement accounts (either your personal account or your company’s pension plan).Cash transfers to vendors and suppliers.

It offers a variety of web-based features to make financial transactions online including: In today’s fast-moving world, businesses use online banking to replace in-person visits to a branch. If you’re thinking of using an online bank for your business, it’s important to weigh its pros and cons and learn how these innovative banking features are changing the way business owners interact with their money. But, more than ever, business owners now rely on this technology to meet their banking needs from the safety and convenience of their homes. Thanks to its advanced web services and mobile apps, online banking had come into the spotlight way before the pandemic.

0 kommentar(er)

0 kommentar(er)